A) places the largest portion of the burden on the sellers of that product

B) places the burden of the tax equally on buyers and sellers

C) places the largest portion of the tax on consumers

D) will make demand more elastic than it was before the tax

E) will make demand more inelastic than it was before the tax

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If political officials want to minimize the excess burden accompanying a tax, they should set the tax at a rate

A) that will maximize the revenue derived from the tax.

B) slightly above the rate that will maximize the revenue derived from the tax.

C) well below the rate that will maximize the revenue derived from the tax.

D) that is the highest that could possibly be imposed.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes create deadweight losses because they

A) reduce profits of firms.

B) distort incentives.

C) cause prices to rise.

D) create revenue for the government.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A proportional tax is defined as a tax for which the

A) average tax rate rises as income increases.

B) average tax rate falls as income increases.

C) average tax rate remains constant at all levels of income.

D) dollar tax liability of those with higher income is the same as the dollar tax liability of those with lower income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will most likely be harmed by legislation exempting teenagers from the minimum wage?

A) a high school student seeking a part-time job

B) a high-skilled, 30-year-old worker who is unlikely to compete with low-skilled teenagers in the employment market

C) a large family that often employs the services of low-skilled, part-time workers

D) an illiterate 40-year-old worker with few labor skills

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal government enacts a new excise tax of $1.50 per case of soda. Which of the following is most likely to occur?

A) Consumers of soda will pay a higher price and buy a larger quantity.

B) Consumers of soda will pay a higher price, which will increase the profits of soda companies, inducing them to sell a larger quantity.

C) Consumers of soda will pay a higher price and buy a smaller quantity.

D) Consumers of soda will buy less bottled water.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

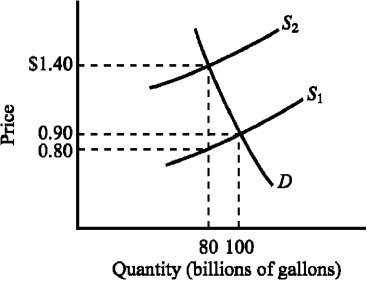

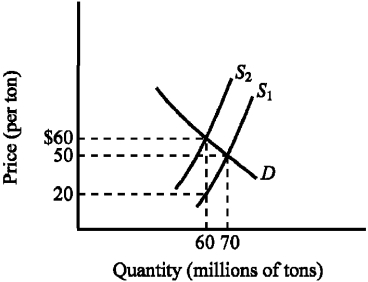

Use the figure below to answer the following question(s) .

Figure 4-7  -Refer to Figure 4-7. The supply curve S1 and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

-Refer to Figure 4-7. The supply curve S1 and the demand curve D indicate initial conditions in the market for gasoline. A $.60-per-gallon excise tax on gasoline is levied, which shifts the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

A) $.50 for buyers and $.10 for sellers

B) $.50 for sellers and $.10 for buyers

C) The entire $.60 falls on sellers.

D) The entire $.60 falls on buyers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

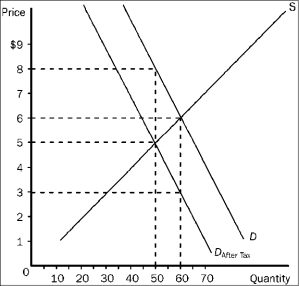

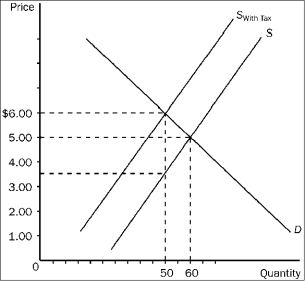

Figure 4-20  -Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

-Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

A) $8.

B) $6.

C) $5.

D) $3.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

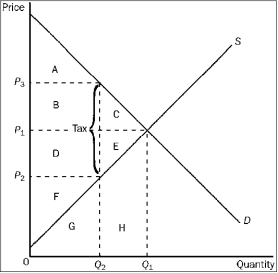

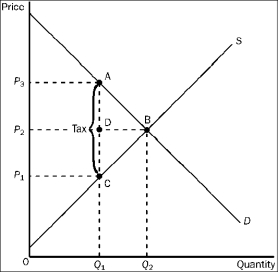

Figure 4-25  -Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

-Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

A) P1.

B) P2.

C) P3.

D) impossible to determine from the figure.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A payment the government makes to either the buyer or seller, usually on a per-unit basis, when a good or service is purchased or sold is called a

A) black market.

B) interest rate.

C) subsidy.

D) tax.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Black markets that operate outside the legal system are often characterized by

A) low profits for suppliers.

B) lower opportunity costs for suppliers and buyers.

C) decreased prices.

D) the use of violence as a means of settling disputes.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the federal government levies a 50 cent excise tax on gasoline and that the demand for gasoline is highly inelastic while the supply is highly elastic. Under these circumstances, the burden of the tax

A) will fall primarily on producers.

B) will fall primarily on consumers.

C) will be split equally between consumers and producers.

D) cannot be determined because the burden of a tax is not influenced by the elasticities of supply and demand.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An excise tax levied on a product will impose a larger relative burden on consumers (and a smaller relative burden on sellers) when

A) the supply of the product is relatively inelastic.

B) the supply of the product is relatively elastic.

C) the demand for the product is relatively inelastic.

D) either b or c is true

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

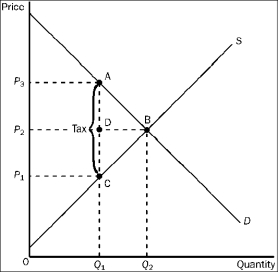

Figure 4-24  -Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

-Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

A) P1.

B) P2.

C) P3.

D) impossible to determine from the figure.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

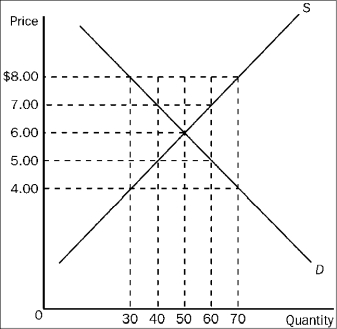

Figure 4-17  -Refer to Figure 4-17. Which of the following price controls would cause a shortage of 10 units of the good?

-Refer to Figure 4-17. Which of the following price controls would cause a shortage of 10 units of the good?

A) a price ceiling of $5.50

B) a price floor of $5.50

C) a price ceiling of $6.50

D) a price floor of $6.50

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 4-22  -Refer to Figure 4-22. The equilibrium price in the market before the tax is imposed is

-Refer to Figure 4-22. The equilibrium price in the market before the tax is imposed is

A) $1.00.

B) $3.50.

C) $5.00.

D) $6.00.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 4-24  -Refer to Figure 4-24. The equilibrium price before the tax is imposed is

-Refer to Figure 4-24. The equilibrium price before the tax is imposed is

A) P1.

B) P2.

C) P3.

D) None of the above is correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following examples illustrates a regressive income tax?

A) I earn $500 and pay $50 in taxes; you earn $1,000 and pay $90 in taxes.

B) I earn $500 and pay $50 in taxes; you earn $1,000 and pay $100 in taxes.

C) I earn $500 and pay $50 in taxes; you earn $1,000 and pay $110 in taxes.

D) I earn $500 and pay $50 in taxes; you earn $1,000 and pay $125 in taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the figure below to answer the following question(s) .

Figure 4-8  -Refer to Figure 4-8. The supply curve S1 and the demand curve D indicate initial conditions in the market for soft coal. A $40-per-ton tax on soft coal is levied, shifting the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

-Refer to Figure 4-8. The supply curve S1 and the demand curve D indicate initial conditions in the market for soft coal. A $40-per-ton tax on soft coal is levied, shifting the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

A) $10 for buyers and $30 for sellers

B) $30 for buyers and $10 for sellers

C) The entire $40 falls on sellers.

D) The entire $40 falls on buyers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the price of a good is legally set below the equilibrium level, a shortage often results. This shortage

A) is a temporary failure of the market mechanism.

B) is the result of a shift in demand.

C) is the result of a shift in supply.

D) occurs because the price ceiling prevents the market mechanism from establishing an equilibrium price.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 254

Related Exams