B) False

Correct Answer

verified

Correct Answer

verified

True/False

The major advantages of monetary policy include its flexibility, speed, and political palatability.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lowering the reserve ratio:

A) Increases the total reserves in the banking system

B) Also reduces the discount rate

C) Turns required reserves into excess reserves

D) Reduces the amount of excess reserves the banks keep

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following varies directly with the interest rate?

A) The opportunity cost of holding money

B) The transactions demand for money

C) The asset demand for money

D) The level of investment

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A newspaper headline reads: "Fed Cuts Federal Funds Rate for Fifth Time This Year." This headline indicates that the Federal Reserve is most likely trying to:

A) Reduce inflation in the economy

B) Raise interest rates

C) Ease monetary policy

D) Tighten monetary policy

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Board of Governors of the Federal Reserve System increases the legal reserve ratio, this change will:

A) Increase the excess reserves of member banks and thus increase the money supply

B) Increase the excess reserves of member banks and thus decrease the money supply

C) Decrease the excess reserves of member banks and thus decrease the money supply

D) Decrease the excess reserves of member banks and thus increase the money supply

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the dollars held for transactions purposes are, on the average, spent four times a year for final goods and services, then the quantity of money people will wish to hold for transactions purposes is equal to:

A) Four percent of nominal GDP

B) 25 percent of nominal GDP

C) Nominal GDP multiplied times 4

D) Nominal GDP divided by 25

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Loans of the Federal Reserve Banks to commercial banks are:

A) A liability of the Federal Reserve Banks and of the commercial banks

B) An asset of the Federal Reserve Banks and of the commercial banks

C) A liability of the Federal Reserve Banks and an asset for commercial banks

D) An asset of the Federal Reserve Banks and a liability for commercial banks

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The conduct of monetary policy in the United States is the main responsibility of the:

A) U.S. Treasury

B) Federal Reserve System

C) Office of Management and Budget

D) Bureau of Economic Analysis

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Bond prices and the interest rate are inversely related

B) A lower interest rate raises the opportunity cost of holding money

C) The supply of money is directly related to the interest rate

D) The total demand for money is directly related to the interest rate

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the Fed creates excess reserves in the banking system by buying government bonds, but banks do not make more loans because economic conditions are bad. This situation is a problem of:

A) "Putting all your eggs in one basket"

B) "Not in my own back yard"

C) "There ain't no such thing as a free lunch"

D) "You can lead a horse to water, but you can't make it drink"

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If bond prices decrease, then the:

A) Interest rate decreases

B) Interest rate increases

C) Transactions demand for money will decrease

D) Transactions demand for money will increase

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

When commercial banks borrow from the Federal Reserve Banks, they decrease their excess reserves and their money-creating potential.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A television report states: "The Federal Reserve will lower the discount rate for the fourth time this year." This report indicates that the Federal Reserve is most likely trying to:

A) Reduce inflation

B) Save the banking industry

C) Stimulate the economy

D) Improve the savings rate

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) Excess reserves may be found by subtracting actual from required reserves

B) The supply of money declines when the public purchases securities from commercial banks

C) Commercial bank reserves are a liability to commercial banks but an asset to Federal Reserve Banks

D) Commercial banks reduce the supply of money when they purchase government bonds from the public

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond with no expiration has an original price of $10,000 and a fixed annual interest payment of $1000. If the price of this bond increases by $2500, the interest rate in effect will:

A) Decrease by 1 percentage point

B) Decrease by 2 percentage points

C) Increase by 1 percentage point

D) Increase by 2 percentage points

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The most frequently used instrument of the Federal Reserve System to control the money supply is the required reserve ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is considered a limitation of monetary policy?

A) The cause-effect chain

B) Its cyclical asymmetry

C) Its isolation from political pressure

D) The speed with which it can be implemented

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the Taylor rule, when real GDP is equal to potential GDP, and the inflation rate is equal to its target rate of two percent, the Federal funds rate should be:

A) 2 percent and this implies a real interest rate of 0 percent

B) 2 percent and this implies a real interest rate of 4 percent

C) 4 percent and this implies a real interest rate of 2 percent

D) 4 percent and this implies a real interest rate of 4 percent

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

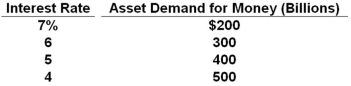

Refer to the table above. Suppose that the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table. If the nominal GDP is $2000 billion, the equilibrium interest rate is:

Refer to the table above. Suppose that the transactions demand for money is equal to 20 percent of the nominal GDP, the supply of money is $800 billion, and the asset demand for money is that shown in the table. If the nominal GDP is $2000 billion, the equilibrium interest rate is:

A) 4 percent

B) 5 percent

C) 6 percent

D) 7 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 174

Related Exams